- Strategic Planning - assess new business units and new technologies within your business.

- Program Management - for installation of your large assets, roll-outs and new processes.

- Efficiency Studies - time-motion, workflow, buffers, production and assembly.

- Statistic Gathering - penetration and adoption rates, data by postal/ZIP code, and trend analysis.

Taking risks is a necessity, yet no group of tough decisions will all work-out perfectly. We help our clients see the opportunities and the risks, and do so with a view of how the telecom industry currently works, from both the provider's and customer's perspective. Because we have worked for large telecom companies, we know and have studied how internal biases are unwittingly created, and how those thoughts can lead to misconceptions. Bias can and does exist everywhere...in the boardroom, with shareholders, with employees and certainly with customers. The need to overcome well-intentioned but incorrect assumptions was a key reason we started AG Advice and Support. It seems strange that any one of us could not easily recognize our lack of objectivity. If we could, we wouldn't act that way in the first place. Yet as the old adage opines, "If you were biased, how would you know?"

That's one of the ways we will help you, and several more are discussed below. Whatever the nature of our assistance might be, our absolute minimum goal is to ensure that all costs related to our services are offset with a cost savings or revenue improvement to you. And of course, we strive to offer both.

We have made recommendations for several large corporations in the food & beverage, gaming and hospitality, telecommunications, and other industries. We have also assisted several small and medium-sized businesses with the determination and roll-out of new hardware, test or internal processes, as well as with their marketing and selling plans.

Program Management

AGAAS has worked on several projects to install and turn-up GTD-5 EAX® base unit telephone switches -- in 5 weeks -- around half of the usual time. We have also helped design workflow processes for repair and test procedures for large quantities of repair assets, in some cases improving efficiency by over 100%.

Efficiency Studies

Speaking of efficiency, we have had significant experience breaking tasks down into their core components, and then testing and measuring the time and success of each series of movements, for activities like manufacturing, testing and repair. For example, in one case we improved the speed of manufacture for a small production line of electronics equipment from 12.0 hrs/unit to 2.5 hrs/unit, while in another we reduced the 8 week training period of several telecom courses to 2 weeks. Not all improvements are such low hanging fruit, but we always find ways to better efficiency, such as recovering valuable inventories that were previously written-off, reducing time-consuming quality systems that most employees dislike into short, user-defined procedures, automating analysis or calculations that had required hours of manual effort, or designing systems that offer more predictable, understandable and comparable outcomes.

Statistic Gathering

Whether it be market research interviews with the general public, comparisons of hotel accommodations and amenities in Las Vegas, or the flavor of coffee in three different continents, AGAAS has performed statistical research for several large companies. Sources for our statistics sometimes include publicly-available information from the US Bureau of Labor Statistics, US Census Bureau, the ITU, etc., or from subscription-based services of the United Nations, the National Association of Realtors, etc. But frequently, our most interesting results come from our own original research, which is typically conducted through direct interviews of the public, surveys, and on-premise analysis.

And certainly within the boardrooms of Internet Service Providers (ISP's), these topics are also discussed frequently. But actions speak louder than words. Through the year 2009 and into 2010, there still does not yet seem to be an urgency for many ISP's to rollout faster pipelines into homes and offices, and where they are being rolled-out, some difficulties are popping-up along the way. The Broadband: A Review article and the sidebar both try to find out why there are challenges, what to do about them, and which solutions may be best for the future.

As specialized service and content providers erode revenue from traditional telecom providers, a window of opportunity is closing. While revenues from DSL and land-line phone services are still robust, these companies must act now to aggressively build-out fiber-to-the-prem networks, plus carefully consider the fastest upcoming wireless technologies, leap-frogging an intermediate technology like 2.5 or 3G in favor of immediate adoption of 4G. Cable-based TV and telecom companies have an advantage only in that they have a few years' more time than traditional phone companies to make network upgrades, as even cable bandwidth will not be able to compete will newer fiber and wireless networks over the next 10-20 years, which themselves will eventually become cheaper to run and maintain than any of today's networks.

Wireless and fiber based utility providers have undergone enormous expense to build their networks, even suffering backlash from customers and shareholders for doing so, but these two types of networks will offer an overwhelming performance advantage in the future, permanently shifting market share in their favor to wherever they operate.

De-convergence, the offering of single-services by specialized providers, is likely to grow. These low-cost providers will eventually pay rates for bandwidth closer to their cost, but will still enjoy lower business costs than traditional telecom providers for some time due to favorable regulatory policies, pressuring margins across the industry. As the costs of fiber network build-outs by traditional phone companies are finally paid back, maintenance costs are expected to be lower than that of copper or coax, allowing those utility owners to start improving margins once again.

Traditional phone or cable companies who are unable to upgrade to fiber or the latest wireless networks, for whatever reason, are literally faced with extinction because their networks cannot offer the performance increases that will be expected by customers. Even if technology provided one more stop-gap measure to allow improve network performance, the cost of upgrades and maintenance typically require years or decades to make them profitable. That's too long when compared to simpler and incremental upgrades for wireless and fiber. US federal and state broadband initiatives may soon offer some assistance with costs to roll-out new technologies, but they will not likely match the level or scope of assistance that certain European or Asian nations have undertaken, and unfortunately, will almost certainly come in too little portions and will arrive too late for US telecom providers to significantly better their competitive position.

Introduction

Traditionally, the actual utility that phone companies rented to their customers was a twisted copper wire pair, and some portion of a switching network that routed their phone calls. The revenue from this basic infrastructure funded many improvements and new technologies over the years. Now that the actual utility itself it changing, what will a "phone" company look like in 20 years?

No one truly knows yet, but we can define some of the aspects that will change. Copper wire pair and all of its iterative technologies will still exist as a form of broadband, but it will have declined to near last place when compared to competing technologies. Far more dominant will by a hybrid network of fiber and wireless, possibly with "satellite to the neighborhood". Even coaxial cable is likely to decline significantly in popularity. But changes to the content provided will also occur, and it will not necessarily make sense to traditional telecom providers. For example, we have heard about convergence and its technological and marketing advantages for 20 years now. Yet, there will be resellers or content-only providers who will offer just one thing, like VoIP and they will be able to undercut industry pricing for their signature service, drawing power users away. Call it "de-convergence".

But it won't matter too much to the companies providing the updated communications utilities -- those who own the actual fiber-to-the-home and wireless networks -- because everyone will need a utility connection of some sort. Competitor's offerings will still rely upon an existing internet connection in order to function, and they will not typically be able to build-out these networks themselves due to the terrific expense.

However, time is of the essence for traditional telecom companies. Though the enormous cost of building new networks may be prohibitive to these specialized competitors, it will still be heavy-lifting for traditional telecoms. The upgrades must be paid for from revenues earned today from existing DSL or the content itself, before they drop-off due to competitive pressure from other providers who will offer faster or more convenient services. The difficulty is compounded for traditional telecoms due to current regulatory policy which significantly favors new, content-only service providers, like VoIP -- which is really just content of data packets -- sent over a broadband utility of some sort.

Some Facts

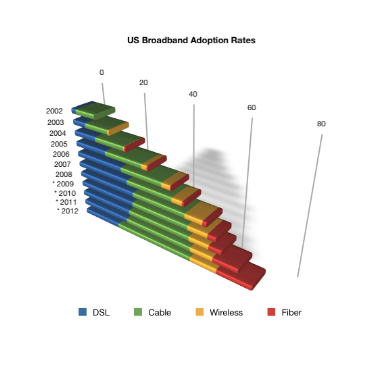

As adoption rates for new IP technologies are finally poised to hit double-digits, DSL and even cable are facing major challenges. We've been hearing about convergence for over 20 years, but as technologies play themselves out -- in terms of cost, speed, and reliability -- things are changing in unforeseen ways. For example, how dominant will 4G wireless become in both traditional wireless and wireline markets? Who would have thought that dial-up internet through 56Kbps modem would still maintain over 10% market share in the year 2009?

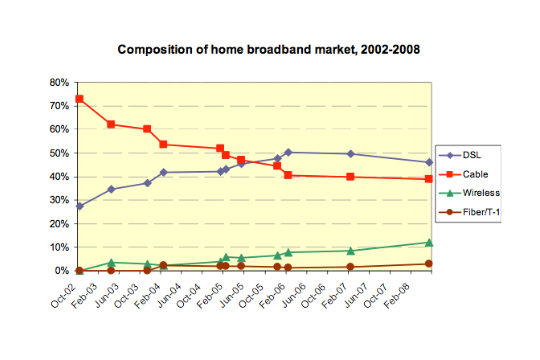

But changes are coming. Look at the following chart which shows the share of each broadband technology for the home market. Note this chart does not offer information on non-broadband technology like dial-up or semi-broadband like satellite. Several interesting conclusions can be drawn:

- Both DSL and cable are giving way to momentum in wireless and fiber delivery technologies.

- Cable's 75% dominance as recently as 2002 has now dropped below 40%.

- The price point of DSL has at least temporarily given DSL market share gains over cable.

Courtesy Pew Research Center.

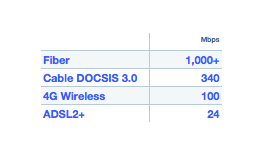

Fiber is practically limited by the quality of laser diodes, backbone infrastructure and merchandising decisions, but can easily offer 1Gbps and higher. HDSL and ADSL offer around 24Mbps, an amazing accomplishment for twisted wire pairs, but despite their lower pricing, are starting to look slow compared to alternatives.

Due to consumer tightening, spending on broadband is expected to moderate somewhat when compared to adoption rates of other new technology in the 1990's. Even so, broadband is expected to penetrate 70% or more of all US households.

US national broadband prices currently average $33/month for DSL and $37 for cable. This $30-40/month range seems to delineate most customers, above which they expect the most recent technologies, and below which only basic internet connectivity is desired. Future lower maintenance costs of fiber may eventually invert this price relationship to DSL, although its roll-out costs are still high enough that this may take a decade or more. However, it is important to consider this type of possibility when choosing a technology today. Wireless, for example, typically requires expensive upgrades every few years to remain competitive.

* Projected. Courtesy AG Advice and Support.

DSL, in all of its forms, will still likely maintain significant market share due to its lower overall cost to about 2012, particularly as PSTN telcos find it necessary to discount or bundle to maintain their customer base. But inevitably, DSL will decline as real-world speeds in other technologies jump an order of magnitude over what it can offer, and as economies of scale make those better technologies cheaper. In as soon as 5 years, DSL seems destined to become the new dial-up.

Of course, telcos will increasingly offer fiber-to-the-home and fast wireless, as several do now. The problem is the cost to upgrade has forced many telco's to delay or simply not offer these technologies yet. With the exception of certain small rural markets, it is not possible to maintain a majority-DSL model. Government broadband mandates and customer expectations will force telcos to offer competitive broadband. This seems difficult to reconcile with stagnant or dropping revenues and reluctant rate-rebalancing decisions from regulators. However, starting even modest FTTP initiatives now may indicate a good-faith attempt by a telco to offer its customers the latest technology and indicate to regulators that a telco is doing what it can to update its network.

Though strong today, cable providers must remain vigilant to maintain their market share. Many telcos have watched DSL give way to cable providers over the last decade. It seems possible that traditional cable providers will encounter the same effect with their markets as fiber and wireless providers might over take them with intriguing alternatives. However, cable networks have several strengths still.

On one hand, cable providers can easily bundle a television and telephone package with internet service, and for the next several years offer download speeds that will likely provide an excellent cost-to-speed value. DOCSIS standards may continue to evolve, plus fiber can be run to the neighborhood, with cable the last quarter mile to the home, giving cable customers very fast, real-life speeds. The problem is, what happens then?

Coaxial attenuation increases rapidly with higher frequencies. At 1GHz and higher, it becomes difficult to run cable for lengths over 100 feet without the use of expensive repeaters. Wireless and fiber will keep up with, and then likely usurp, cable's speed within 5 years time. Although the roll-out cost of these two competitors are higher today than cable, that will likely change as those networks become larger and start to enjoy economies of scale. The real problem for cable is the long-term future. Coaxial cable is somewhat similar to twisted wire pair in its upkeep and replacement cost. It seems inevitable that providers who offer copper-anything must eventually choose a faster to-the-home medium like fiber or a centralized one like wireless. Revenue streams for cable providers are strong, and can fund upgrade initiatives now. Therefore, cable providers should consider network upgrades now, before future competition and lower margins make it more difficult to do so.

3G and 4G wireless will eventually saturate urban markets, but unlike fiber, have the obvious appeal of mobile connectivity. This type of service naturally appeals to enterprise, professionals and other more affluent customers, which makes it likely to earn good margins. WIth its 100Mbps mobile and 1Gbps stand-still speeds specified, 4G can quite reasonably be expected to act as the sole manner of connecting to the internet for many conventional customers, particularly if bundled with cellular telephone and long-distance calling service. Indeed, the latest wireless speeds could quite easily support real-time high definition video, allowing for television to also be included in the bundle. 4G is also much faster than existing free 802.11x wifi and might allow for revenue to be earned in areas that otherwise were offering free internet. Finally, mobile internet for aircraft or regular consumer vehicles is on the cusp of becoming widely available.

There are still challenges ahead for wireless. Centralization of the serving radio equipment has always made it more susceptible to overloads or common-control outages, something that many users will not tolerate well. Costs to continually upgrade...both the serving equipment plus customer modems and handsets...is often significant, and required in order to keep up with the competition. There is also some lingering concern about indefinite exposure to RF signals, something that AG Advice and Support has been involved with assessing. Although an absolute consensus is still not clear, there is a possibility of future of claims being made against providers for the effects of prolonged RF exposure, whether those effects be real or perceived.

If you want to offer the fastest speed for the long-term, there is really only one choice. Fiber will be technologically superior, but its price point will at least temporarily delay double-digit market share, particularly if consumer spending is restrained due to economic hardship. But the need and desire for increased speeds -- for both enterprise and affluent consumers -- will continue to grow, and so will their willingness to pay for premium service, which eventually will help pave the way for cheaper prices in the future as the size of the fiber network grows.

Fiber is currently being priced to compete with high-speed cable, offering good margins that are comparable to the fastest cable internet rates. But technologically, fiber offers 1 giga-bit-per-second and better to the home, today. In the future, it will easily be able to offer much faster speeds again. Only the customer's optical network device (OND) modem and a region's given backbone infrastructure limits this. This alleviates future upgrade costs for the provider, either shifting it to the customer or in the case of backbones, adding it just-in-time, and just-where-needed. Upgrading fiber-to-the-home is expensive upfront, and is currently achieving moderate adoption rates, but in the long term, it offers the fastest, safest and most-easily maintainable network. It is a true utility, comparable to the task of the original copper wire telephone networks in the early and mid 20th century, but is similarly an investment for the 21st century.

____________________________________

Conclusions

So which technology will dominate the next decade, and which will customers most want? It will depend upon regional preferences, income, geography and competition. It will also depend on grade-of-service and upcoming changes in regulatory law.

A hybrid of fiber and wireless would seem to offer the most complete service for customers, without reference to cost. Fiber offers a very long-term and an almost insurmountable performance advantage when compared to its other alternatives, and ensures revenue even if VoIP competitors should take away from traditional POTS revenue streams. 4G wireless will offer HDTV-capable speeds even while mobile, and for some customers will act as their only means to connect to the internet. But the challenge of offering just these two services is both their very high costs to role-out, plus the difficulty of offering a cheaper internet product to those who cannot afford premium services. Even if providers wished to offer cheaper service though an all-fiber network for simplicity, this could cause unintended regulatory impacts and customer expectations.

Cable will remain a strong competitor for the next several years, and will be able to do so with minimal upgrade costs. Typically only demarcation and multiplexing interfaces would require upgrades, allowing for multiple channel or cable bonding to deliver higher bandwidth to homes for a good value to the customer. However, copper-based coax will have difficulties offering speeds beyond 1Gbps, even with technological improvements. This somewhat arbitrary barrier will likely become important as fiber and certain wireless services soon offer and surpass this benchmark.

DSL has perhaps 5 more years of decent revenue from double-digit broadband market share, after which its popularity can be expected to decline steadily and significantly. Consumer buying power will affect this decay somewhat, but providers relying upon xDSL should consider upgrading their networks soon, if even just in small portions, while they still have cash streams to pay for it.

Of course, the problem for traditional PSTN telco's and even cable providers is the cost of upgrades, which can be enormous, and depending upon the technology used, fleeting. There are several methods of mitigating this, although many will have variable success. For example, the building boom during the earlier part of this decade was the best time to trench or bury conduit for future fiber roll-out. Unfortunately, many builders and city planning departments did not foresee or did not put enough emphasis upon this. However, any new building project -- home or commercial -- should have fiber drop planning set in place when other communication connections are being considered. In many cases, the buyers of the property could pay for much or all of the fiber drop efforts that occur within their property lines, as they would for any other sort of utility. Curiously, this still isn't being done in many places. It requires, in part, advocates from the communications providers to work with municipal planners and builders.

Income-per-ZIP, proactive site surveys, and other methods can be used to determine where network upgrades of existing equipment should be started first, although these things are often undertaken only when an opportunity presents itself. This is too uncertain and spotty. Direct intervention and advocacy from service providers is required. Improving proactive coordination with municipalities and other utility providers to lay conduits during underground digs also allows for an innovative way of cost-spreading. Also, while many nations in Europe and Asia have enjoyed significant, tax-payer funded broadband infrastructure improvements, the American Recovery and Reinvestment Act of 2009 has now provided at least some financial assistance for a US national broadband initiative. Although the current financial commitments are modest compared to what is required, many US states have also launched their own initiatives.

But perhaps the most important issue for broadband providers is when the changes will likely occur. Providers must start making these decisions soon, while they still have decent cash flows on hand. Several telephone providers have recently found themselves in financial distress or even bankruptcy re-organization. We do not see this as a transient set of events -- it will likely continue for some time. The future very much favors those who have a modern high-speed network utility which they can sell to their customers, or those who have the cash flow to start building a new network. Companies unable to afford such an investment, for whatever the reason, are placing their businesses at a serious and imposing disadvantage. Like melting ice, there is only so much time to begin such investments before circumstances overtake and decree it, or the business will eventually atrophy into nothing.

Copyright, 2009, AG Advice and Support, LLC.